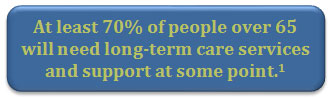

All our services focus on being a guide for you to reach your financial goals, whether they be a comfortable retirement, travelling the world, education for your loved ones, or anything else that your heart desires. One of the first things any good guide will discuss with you is safety. One of the most dangerous perils for a stable retirement plan is an extended healthcare event that requires you to draw on your retirement assets to provide for long periods of care for yourself or your spouse.

We know that individuals are living longer but not necessarily living those years in the best of health. The best place to start is having a conversation about how and where you would like to receive care and decide how involved your loved ones would like to be in the plan. There are many options available to you to plan for a long term healthcare event and we are here to guide you through the options so you and your family can decide on the best long-term care solution for you.

Please enjoy the following free resources provided to guide you and your family in talking about your plan for an extended healthcare event. When you are ready to talk about your options, we are here for you.

Hear Rob Lowe, Maria Shriver, and others have “The Talk” about long-term care planning:

1 2018 U.S Department of Health and Human Services (www.longtermcare.acl.gov), 10/10/17. site accessed 11/05/18.

2 Genworth Cost of Care Survey 2018, conducted by CareScout®, June 2018

A Based on annual rate divided by 12 months (assumes 44 hours per week)

B Based on annual rate divided by 12 months

C As reported, monthly rate, private, one bedroom