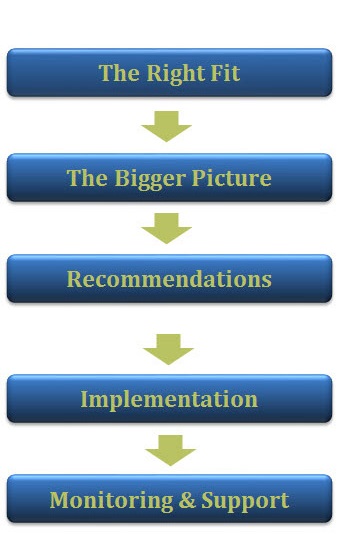

Developing a plan to help you live the life you desire is a process and we are guiding you every step of the way. These are the steps you can expect as we develop your personal Plan to Prosper.

Step 1 — The Right Fit

At our free initial consultation, we will discuss your story, your desires, fears, and what drives you forward. Tell us about how you see the future and what is most important to you. We will share our philosophy and make sure we are a good fit for you.

Step 2 — Sharing the Bigger Picture

Together, we will define your goals and dreams and assess where your finances stand today. This is a great time to tell us about your investment history, your comfort level with the market, and what concerns you.

Step 3 — The Recommendations

We evaluate your financial standing and provide you with a personalized plan to align your financial life with your goals. Here we firmly commit to one another to work toward your near-term and long-term goals and decide the best strategy to move forward.

Step 4 — Implementation

Together, we put the strategies you select to work and make changes where needed to your current finances. As changes are made, it is important to know that any tax consequences or estate plan changes are kept in the forefront of our minds.

Step 5 — Ongoing Support

You will see your plan shaping into results for your long-term goals and we are here to keep you on track. As life changes, so will your plan need to change and we can update it for the large life events as they happen.